Data Acquisition (DAQ) System Market Size:

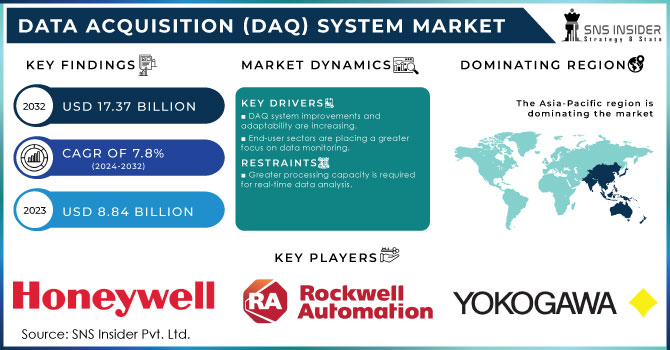

The Data Acquisition (DAQ) System Market size is expected to be valued at USD 10.27 Billion in 2025E. It is estimated to reach USD 18.73 Billion by 2033, growing at a CAGR of 7.8% during 2026-2033.

Get more information on Data Acquisition (DAQ) System Market - Request Sample Report

DAQ systems play a vital role in sectors such as manufacturing, aerospace, automotive, healthcare, and energy, where accurate monitoring and control are necessary. These systems change analog signals to digital information, enabling in-depth examination, oversight, and management of operations. As automation and IoT gain more popularity in industries, the need for advanced DAQ systems is increasing, becoming a crucial element in the changing industrial and technological landscape. In 2024, more than 30 billion IoT devices are currently being used, thanks to substantial investments expected to surpass USD 800 billion. The use of IoT devices is popular among consumers in developed areas, with over 70% of households owning at least one device. Industrial IoT is at the forefront, accounting for over 40% of all market expenditures.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 10.27 Billion

-

Market Size by 2033 USD 18.73 Billion

-

CAGR of 7.8% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Data Acquisition (DAQ) System Market Trends:

-

Growing emphasis on real-time data monitoring across manufacturing, automotive, energy, and healthcare sectors to improve operational efficiency and compliance.

-

Increasing reliance on data acquisition (DAQ) systems for efficient collection, processing, and analysis from sensors, machines, and devices.

-

Rising adoption of Industry 4.0 technologies, including IoT, AI, and ML, driving demand for accurate and continuous data collection.

-

Enhanced focus on predictive maintenance and process optimization using collected data to reduce downtime and improve quality.

-

Expansion of smart manufacturing practices in aerospace and automotive industries, requiring integrated DAQ systems for precise monitoring and control.

Data Acquisition (DAQ) System Market Growth Drivers:

-

End-user sectors are placing a greater focus on data monitoring.

The end-user sectors such as manufacturing, automotive, energy, and healthcare, among others, have been prioritizing data monitoring as a way to bolster operational efficiency, regulatory compliance, and competition. Real-time data collection and analysis is becoming essential in multiple industries and a necessity to optimize processes, reduce downtime, and improve the quality of products and assets. There are a variety of reasons why this trend of data monitoring is not on the decline. These may include the increasing necessity to make quick, data-driven decisions, be mindful of the changes in the market, as well as the standard to which multiple sectors are held, and a set of regulatory requirements that organizations recognize are easier to follow with the help of DAQs. DAQ systems allow efficient data collection, analysis, and processing from various sources such as sensors, machines, and devices.

Data Acquisition (DAQ) System Market Restraints:

-

Greater processing capacity is required for real-time data analysis.

The DAQ market is limited by the growing need for increased processing power for real-time data analysis. As businesses increasingly depend on instant monitoring and decision-making, there has been a significant increase in both the quantity and intricacy of data produced. Conventional DAQ systems, initially intended for managing moderate amounts of data, face challenges in dealing with this large volume. Real-time data analysis demands systems capable of instantly processing and analyzing data, causing significant stress on the processing capacities of DAQ devices. The difficulty lies in the fact that improving processing capacity requires more than just faster processors, it also involves upgrading the entire infrastructure, such as memory, storage, and data transfer capabilities. These outcomes may include increased expenses, higher energy usage, and possible delays in processing. Moreover, incorporating these sophisticated systems into current configurations without causing disruptions presents further difficulties.

Data Acquisition (DAQ) System Market Segment Analysis:

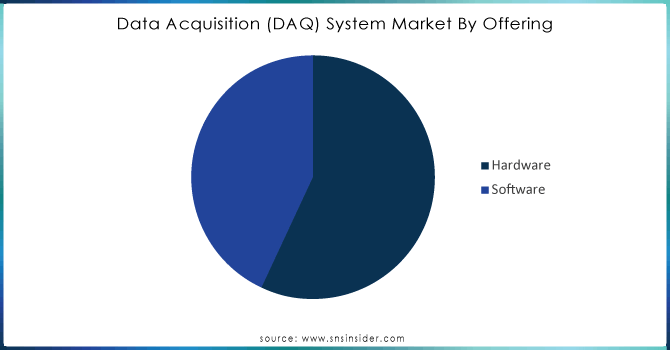

BY OFFERING

The hardware segment dominated the data acquisition system market in 2025E with a market share of over 54%. DAQ hardware is widely used due to its modular design and the possibility of configuring numerous mixes, which allows it to fit a wide range of production test applications. Furthermore, the adoption of Ethernet is increasing, owing to factors such as integration and flexibility, which are fueling the growth of the DAQ hardware market. The need for DAQ hardware is also increasing as it is widely deployed in the development of applications in the sophisticated measurement, lab/R&D, automotive, and Aerospace & Defense markets. In the DAQ and control industrial applications, the external chassis and module increase productivity and performance. The shift to USB- and cutting-edge ethernet systems, which enable rapid discovery rates and higher PC computing and performance, is fueling the growth of the external chassis and module market.

Need any customization research on Data Acquisition (DAQ) System Market - Enquiry Now

BY SPEED

The high-speed segment (>100 KS/S) led the market in 2025E with a market share of around 55% and is also expected to be the fastest-growing segment during 2026-2033. The growing need for fast data processing and analysis in sectors like automotive, aerospace, defense, and telecommunications is fueling this trend, as timely data collection is essential for live monitoring, testing, and decision-making. With the advancement of technology, the demand for fast data acquisition systems is increasing, leading to the sector's dominance and swift expansion in the market.

BY INDUSTRY VERTICAL

The aerospace & defense segment had the major market in 2025E, more than 41%. The growth of the aerospace & defense vertical market of the DAQ system is supported by the necessity to test aircraft and their components having implemented real-time monitoring features against different boundaries and extreme environmental challenges. These systems play a crucial role in making sure that aerospace products and components meet specific performance requirements during a wide range of tests. These assessments are accomplished in the design, production, and development phases of aerospace components. They are also important for detecting that the components withstand the forces and pressures applied during their test.

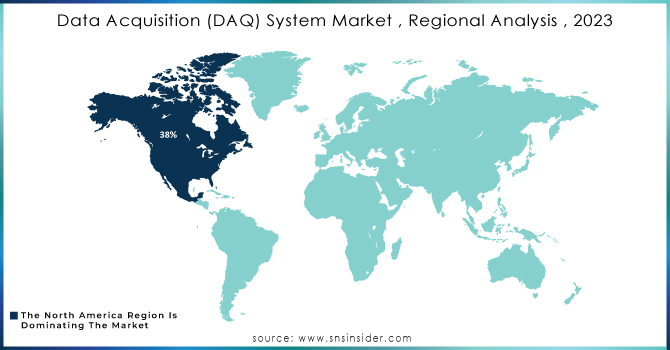

Data Acquisition (DAQ) System Market Regional Analysis:

North America Data Acquisition (DAQ) System Market Insights

North America dominated the market in 2025E with a market share of more than 38%, due to the increased presence of automation and real-time data processing in various industries. Cars, aircraft, and energy production processes, among other things, use DAQ systems to control and monitor operations. Regulating the parameters of the processes improves their efficiency and performance. In automotive applications, information from various sensors installed in vehicles is gathered and studied using DAQ systems. The implementation of the IoT and Industry 4.0 initiatives contributes to the growth of the market for DAQ systems because these technologies necessitate effective tools to manage and analyze data.

Asia Pacific Data Acquisition (DAQ) System Market Insights

Asia Pacific is expected to rise at the highest CAGR during the forecast period 2026-2033. The growth of the market in APAC is mainly attributed to rapid advancements in technologies and increasing manufacturing units, stringent regulatory policies about testing and measurement of products, strong government support towards manufacturing and adoption of new technologies such as AI, and IoT, and the presence of key players in the region. Moreover, the presence of countries such as China, Japan, and India develops a need for the country, as China is the largest vehicle manufacturer in the APAC region. Also, the increasing penetration of different automotive OEMs/plants in the regions owing to the rising demand for automobile production is filling the demand for the APAC data acquisition system market.

Europe Data Acquisition (DAQ) System Market Insights

The European DAQ system market is growing steadily, driven by strong adoption of Industry 4.0, smart manufacturing, and automotive innovations. Demand is fueled by aerospace, energy, and healthcare sectors prioritizing real-time data monitoring, process optimization, and regulatory compliance. Government initiatives supporting digitalization and advanced manufacturing technologies further enhance DAQ system deployment across key European countries.

Latin America (LATAM) and Middle East & Africa (MEA) Data Acquisition (DAQ) System Market Insights

The DAQ system market in LATAM and MEA is emerging, supported by increasing investments in industrial automation, energy infrastructure, and manufacturing modernization. Adoption is rising in aerospace, automotive, and healthcare sectors, where real-time data collection, predictive maintenance, and process efficiency are critical. Collaboration with global technology providers is helping expand DAQ system penetration in these regions.

Data Acquisition (DAQ) System Market Key Players:

The key players in the Data Acquisition (DAQ) System market are National Instruments Corp, Spectris PLC, Honeywell International Inc, Siemens Digital Industries Software, Dataforth Corporation, Teledyne Technologies Incorporated, ADLINK Technology, Yokogawa Electric Corporation, Keysight Technologies, Rockwell Automation Corporation & Other Players.

Competitive Landscape for Data Acquisition (DAQ) System Market:

National Instruments (NI) is a leading provider of data acquisition (DAQ) systems, measurement, and test solutions for industrial, automotive, aerospace, and healthcare sectors. Its platforms enable real-time data monitoring, analysis, and automation, supporting Industry 4.0 adoption, smart manufacturing, and high-precision process optimization across global end-user industries.

-

In April 2024, National Instruments has introduced a new update to the FlexLogger software and made data acquisition systems even more flexible. The new update covers real-time data visualization, the development of more sensors, and more capabilities of advanced automation. Increased capability of its user interface will allow engineers to implement tests faster and manage test sequences more efficiently compared to traditional scripted automation sequences.

Keysight Technologies is a global leader in test and measurement solutions, offering advanced data acquisition (DAQ) systems, instrumentation, and software. Its products support real-time monitoring, high-precision testing, and analytics for aerospace, automotive, energy, and industrial sectors, enabling smarter manufacturing, process optimization, and adoption of Industry 4.0 technologies worldwide.

-

In July 2024, Keysight Technologies introduced a new data acquisition system, the DAQ970A with a high focus on both precision and reliability. The system features a 3-slot mainframe, 6.5 digits DMM, 8 switch and control modules as well as great measurement logging capabilities, which is important in many cases of more complex testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 10.27 Billion |

| Market Size by 2033 | USD 18.73 Billion |

| CAGR | CAGR of 7.8% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software) • By Speed (High-Speed (>100 KS/S), Low-Speed (<100 KS/S)) • By Industry Vertical (Aerospace & Defense, Wireless Communications & Infrastructure, Automotive & Transportation, Power & Energy, Environmental Monitoring, Food & Beverage, Healthcare, Others) • By Application (Manufacturing, R&D, Field, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | National Instruments Corp, Spectris PLC, Honeywell International Inc, Siemens Digital Industries Software, Dataforth Corporation, Teledyne Technologies Incorporated, ADLINK Technology, Yokogawa Electric Corporation, Keysight Technologies, Rockwell Automation Corporation |